Atari and Sequoia Capital: The Venture Bet That Defined Gaming's Future

In 1972, Nolan Bushnell and Ted Dabney founded Atari in Sunnyvale, California..

The Dawn of a Digital Revolution

In 1972, Nolan Bushnell and Ted Dabney founded Atari in Sunnyvale, California, naming it after a term from the Japanese board game Go that signifies a critical, game-changing move. What began as a coin-operated arcade game company would become a cornerstone of Silicon Valley’s venture capital ecosystem. Atari’s journey-from Pong prototypes built with Walgreens TVs to a $28 million acquisition by Warner Communications-exemplifies how visionary entrepreneurs and risk-tolerant investors like Sequoia Capital’s Don Valentine fueled the gaming industry’s explosive growth. This paper explores Atari’s groundbreaking role as one of the first VC-backed gaming companies, the dynamic between Bushnell and Valentine, and the enduring lessons for innovation and investment.

The Atari-Sequoia Partnership: VC Blueprint

Nolan Bushnell’s Vision and Early Struggles

Bushnell, a former engineer at Ampex, combined technical ingenuity with a carnival barker’s flair for showmanship. Atari’s first hit, Pong (1972), revolutionized arcades, generating $400 weekly per machine-equivalent to ~$2,500 today. However, scaling production strained Atari’s finances. By 1974, competition from Pong clones and a failed Japan venture pushed the company toward bankruptcy. Bushnell needed capital to fund the Video Computer System (VCS), a programmable console that would change gaming.

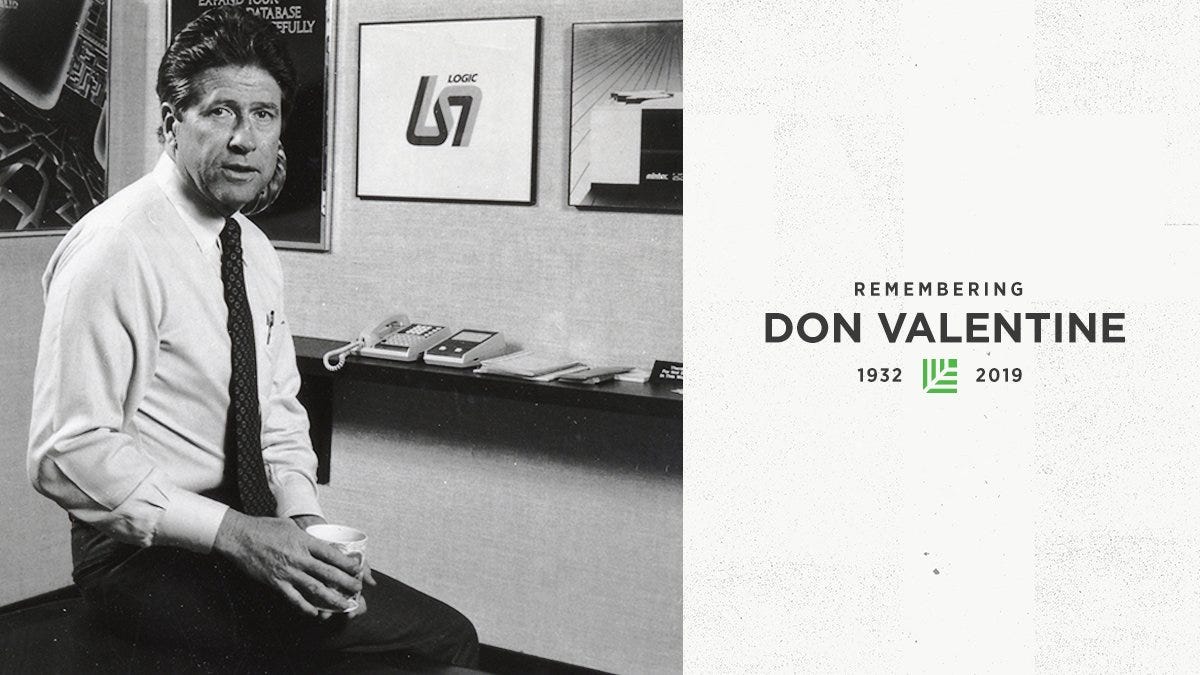

Don Valentine’s Investment

In 1975, Valentine invested $600,000 in Atari-Sequoia’s first deal. Despite Atari’s shaky finances, Valentine saw potential in Bushnell’s audacity and the nascent gaming market. As Bushnell recalled, “Don understood that we weren’t just selling games; we were creating a new form of entertainment.”

Valentine, a veteran of Fairchild Semiconductor, approached venture capital with a strategist’s rigor. His five principles-targeting transformative markets, prioritizing Northern California’s engineering talent, leveraging advanced technology, ensuring high margins, and pursuing $100M+ opportunities-were honed through years of observing Valley’s evolution.

Inside the Partnership

Cultural Clashes and Strategic Wins

The Bushnell-Valentine dynamic was fraught with tension but driven by mutual respect:

The Hot Tub Board Meetings: Atari’s leadership convened in Bushnell’s hot tub, where “wine bottles floated” amid discussions. Valentine, a disciplined strategist, clashed with Bushnell’s freewheeling style but admired his disruptive vision.

Kee Games Gambit: To bypass distributors demanding exclusivity, Bushnell secretly created Kee Games-a “competitor” led by his neighbor Joe Keenan. Kee’s hit Tank (1974) saved Atari from collapse, proving Bushnell’s knack for guerrilla tactics.

The Warner Lifeline: In 1976, Warner acquired Atari for $28 million, providing Sequoia a 4x return. While short of Valentine’s 20x target, the deal validated his bet on gaming’s potential.

Outcomes and Missed Opportunities

Atari’s Peak: Under Warner, the VCS (later Atari 2600) sold 30 million units, dominating 80% of the 1980s console market.

The Apple Footnote: Sequoia’s $150,000 investment in Apple (1977)-led by ex-Atari employee Steve Jobs-was sold prematurely for tax reasons, forfeiting billions in future gains. Valentine later admitted, “We learned to hold through volatility.”

Key Takeaways

Vision Over Metrics

Valentine backed Bushnell despite Atari’s near-bankruptcy because he recognized gaming’s cultural pivot. As highlighted in Something Ventured, Valentine believed, “Markets matter more than margins.”

Timing and Tenacity

Atari’s sale to Warner preceded the 1977 launch of the VCS. While Sequoia missed the console’s peak, the exit funded future bets like Cisco and Oracle.

The Ripple Effect

Atari became a talent incubator: Steve Jobs (Apple), Steve Wozniak (Breakout), and Trip Hawkins (EA) all honed skills there. Valentine noted, “Atari taught Silicon Valley how to scale creativity.”

Legacy: From Pixels to Prosperity

The Atari-Sequoia partnership laid groundwork for modern VC:

Cultural Impact: Atari’s Fuji logo and Pong became pop culture icons, proving tech’s mass-market appeal.

Investment Playbook: Valentine’s focus on market size and founder vision remains central to firms like Andreessen Horowitz.

Cautionary Tales: Premature exits (Apple) and oversight lapses (Atari’s post-Warner collapse) underscore the need for patient capital.

As Bushnell reflected, “We didn’t just build a company-we built an industry.” For venture capitalists and entrepreneurs alike, Atari’s story remains a masterclass in betting big, embracing chaos, and playing the long game.

Sources: Something Ventured (2011), Sequoia Capital archives, Atari historical documents.