CSGO Skins: Gray Markets, Gambling, and Valve's Economy

Grey markets for CSGO skins operate in legal ambiguities, facilitating peer-to-peer (P2P) trades outside Steam’s 15% fee structure

Executive Summary

Counter-Strike: Global Offensive (CSGO) skins represent a paradigm shift in digital asset economies, blending virtual cosmetics with real-world value. This paper examines the $6.7 billion ecosystem ($4.5b skin market cap) driven by Valve’s in-game items, analyzing the symbiotic relationship between grey markets, skin gambling, and centralized sales. Despite regulatory pressures, third-party platforms thrive, fueling demand for case openings and enabling Valve to monetize player behavior indirectly. The hiring of economist Yanis Varoufakis underscores Valve’s early recognition of macroeconomic potential in virtual markets, while decentralized trading models face systemic barriers. CSGO skins’ uniqueness lies in their open-market tradability, rarity mechanics, and community-driven valuation-features absent in closed lootbox systems like Call of Duty. This report synthesizes how Valve’s laissez-faire approach to third-party platforms sustains revenue streams and stabilizes its virtual economy.

The Emergence of CSGO Skins as Digital Commodities

Cosmetic Utility and Rarity-Driven Value

CSGO skins are weapon and glove cosmetics that confer no gameplay advantages but serve as status symbols. Introduced in 2013, their value derives from a rarity hierarchy: Consumer Grade (gray) to Contraband (brown), with Covert (red) and Exceedingly Rare (gold) items commanding premium prices. For instance, the “Dragon Lore” AWP skin sells for over $20,000 due to its 0.0004% drop rate. Unlike static lootbox items in games like Call of Duty, CSGO skins are tradable on Steam’s Community Market and third-party platforms, creating a liquid secondary market.

The Role of Case Openings in Valve’s Revenue

Valve monetizes skin distribution through “cases,” virtual crates requiring $2.50 keys to unlock. In March 2025 alone, 32 million players opened cases, generating $100 million in key sales. Case openings function as a lottery, with players chasing rare skins to resell. This model has yielded $6.7 billion historically, dwarfing traditional game monetization. The psychological pull of rare items mirrors gambling mechanics, yet Valve avoids regulatory classification by framing skins as non-monetary “content”.

The Grey Market: Structure, Scale, and Valve’s Complicit Neutrality

Defining the Grey Market Ecosystem

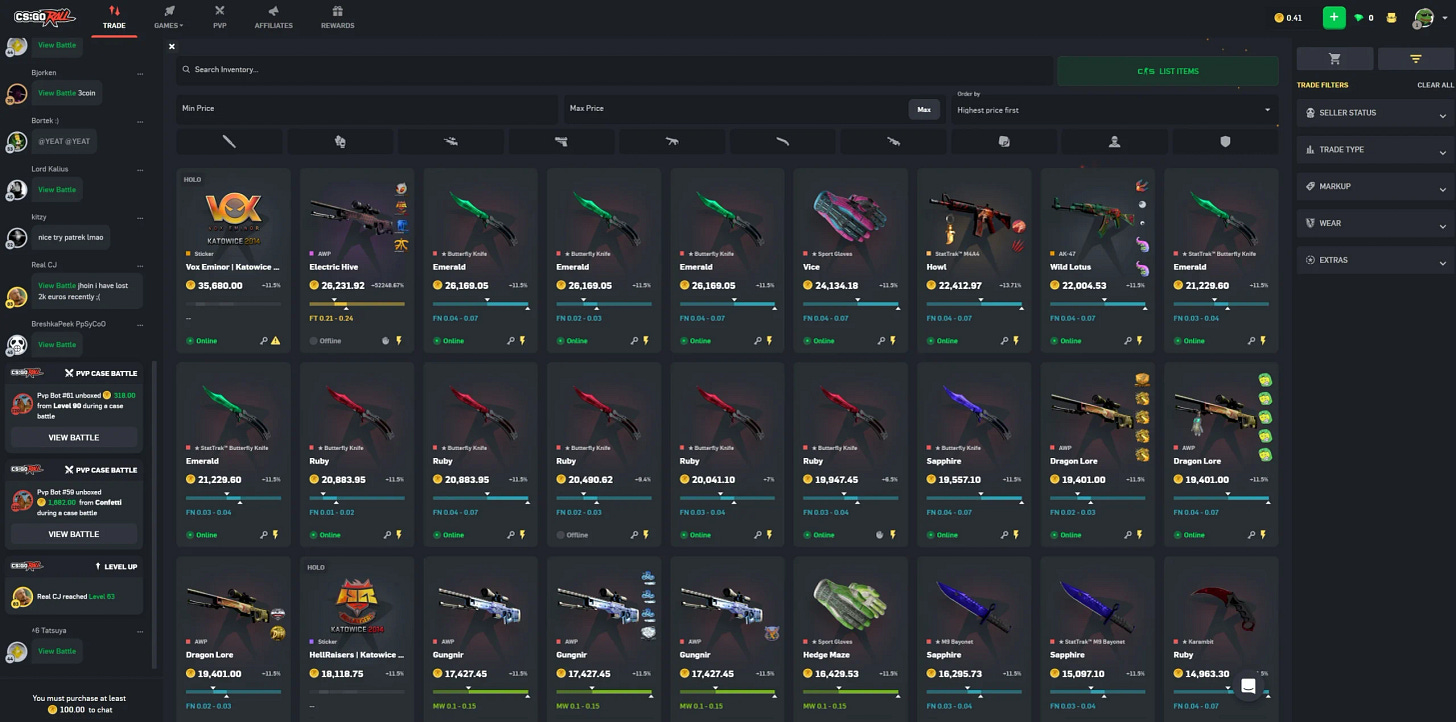

Grey markets for CSGO skins operate in legal ambiguities, facilitating peer-to-peer (P2P) trades outside Steam’s 15% fee structure. Platforms like DMarket and SkinMonkey enable direct skin sales for fiat or crypto, bypassing Valve’s oversight. In 2025, Market.CSGO reported $11.8 million in listed skins, with 95% of users from Eastern Europe. These platforms thrive due to lower fees (5% vs. Steam’s 15%) and faster transactions.

Valve’s Strategic Tolerance

Despite Washington State’s 2016 cease-and-desist order against skin gambling, third-party sites like CSGORoll and CSGOEmpire persist. Valve’s inaction stems from three factors:

Revenue Synergy: Gambling sites increase skin demand, driving case sales. In 2023, 400 million cases were opened, yielding $1 billion in key revenue.

Market Liquidity: Third-party platforms stabilize prices by absorbing excess supply. For example, rare knives circulate across 20 markets, maintaining their $1,000+ valuations.

Regulatory Avoidance: By not directly operating gambling sites, Valve sidesteps liability while benefiting from ecosystem growth.

Skin Gambling: Catalyst for Centralized Sales

The $7.4 Billion Gambling Ecosystem

Skin gambling sites leverage CSGO skins as de facto currency. Players stake skins on roulette, coinflip, and crash games, with platforms taking percentage cuts. In 2016, the CSGO gambling market reached $7.4 billion annually, with jackpot sites alone accounting for $1.9 billion. These platforms create perpetual demand for low-tier skins, which are bulk-purchased for gambling liquidity.

Case Study: CSGORoll’s Impact on Key Sales

CSGORoll, a leading gambling site, offers “free cases” to attract users. To participate, players must purchase skins, often funding acquisitions via case openings. This funnel drives key sales; in 2024, Valve earned $980 million from 400 million case openings. Gambling thus functions as a customer acquisition channel, converting casual players into recurring spenders.

Valve’s Foray into Virtual Economics: The Varoufakis Experiment

Predictive Markets and Economic Stability

In 2012, Valve hired economist Yanis Varoufakis to study in-game economies. His work focused on stabilizing skin markets by mitigating speculative bubbles and fraud risks. Varoufakis proposed using Steam’s 100 million users as a “prediction market” to forecast real-world metrics like inflation-a vision unrealized due to Valve’s gaming focus.

Lessons for Centralized Control

Varoufakis’ tenure highlighted the challenges of regulating player-driven markets. By allowing limited third-party trading, Valve offloads market-making costs while retaining control via Steam’s API. This hybrid model balances decentralization with centralized oversight, preventing systemic crashes like the 2022 $242,000 skin hack on Market.CSGO.

Decentralized Trading: Blockchain’s Promise and Pitfalls

Theoretical Advantages of Blockchain

Blockchain-based platforms propose solving fraud via smart contracts and immutable ownership records. Projects like Skinrave.gg use decentralized ledgers to authenticate skins, reducing counterfeit risks.

Systemic Barriers to Adoption

Despite theoretical benefits, decentralized models face hurdles:

Valve’s Monopoly: Steam’s API controls skin transfers, forcing platforms into grey-market status. White.market’s P2P model still relies on Steam’s infrastructure.

Liquidity Fragmentation: Splitting liquidity across blockchains could destabilize prices, deterring high-volume traders.

Regulatory Uncertainty: Cryptocurrency-based skin trading risks anti-money laundering (AML) scrutiny, as seen in Kazakhstan’s 2024 crackdown.

Why CSGO Skins Outperform Traditional Lootboxes

Open Markets vs. Closed Systems

Unlike Call of Duty’s non-tradable lootboxes, CSGO skins exist in a liquid market where scarcity and demand dictate prices. A 2021 survey found 27% of Steam games derive over 50% revenue from skin sales, highlighting their economic superiority.

Community-Driven Valuation

CSGO skins gain value through:

Aesthetic Appeal: Designer collaborations (e.g., “Howl” skins) and eSports team stickers.

Rarity: Less than 0.1% of cases yield Covert items, creating artificial scarcity.

Cultural Capital: Skins like “Karambit Fade” symbolize elite status, sustaining demand among collectors.

Conclusion: Valve’s Delicate Balancing Act

Valve’s CSGO economy thrives on controlled chaos. By tolerating grey markets and gambling, it harnesses external platforms to drive core sales-a strategy yielding $6.7 billion annually. Decentralized models remain constrained by Steam’s infrastructure, while skins’ uniqueness cements their dominance over traditional lootboxes. Future challenges include regulatory crackdowns and blockchain disruption, yet Valve’s hybrid approach offers a blueprint for virtual asset economies.