DAOs, Scarcity, and Cultural Artifacts: Jodorowsky's Dune and Wu-Tang's Once Upon a Time in Shaolin

The intersection of blockchain technology, intellectual property law, and art preservation has created new paradigms for owning and interacting..

Introduction

The intersection of blockchain technology, intellectual property law, and art preservation has created new paradigms for owning and interacting with cultural artifacts. Two high-profile cases-Spice DAO's acquisition of Alejandro Jodorowsky's Dune storyboard and Martin Shkreli's purchase of Wu-Tang Clan's Once Upon a Time in Shaolin-illustrate the complexities of leveraging decentralized ownership models to manage cultural assets. This paper examines the motivations, execution, and aftermath of these transactions, evaluating their implications for fractional ownership, preservation ethics, and creator credibility.

Case Study 1: Spice DAO and the Dune Storyboard

The Auction and Its Ambitions

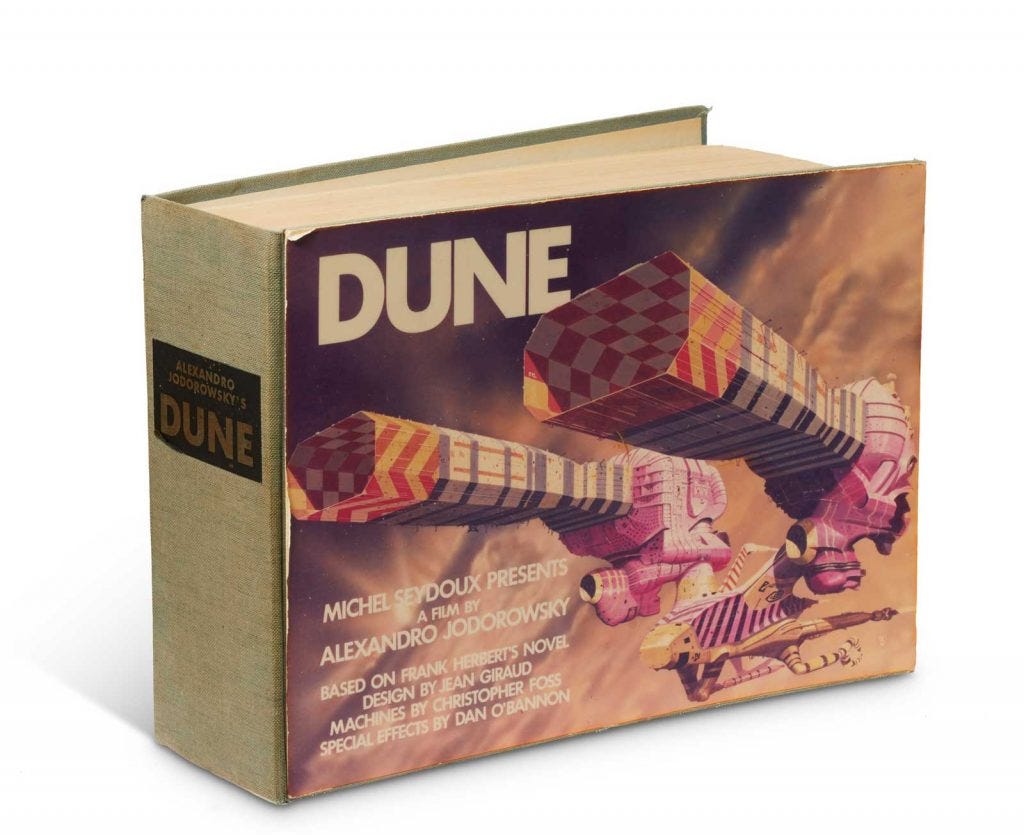

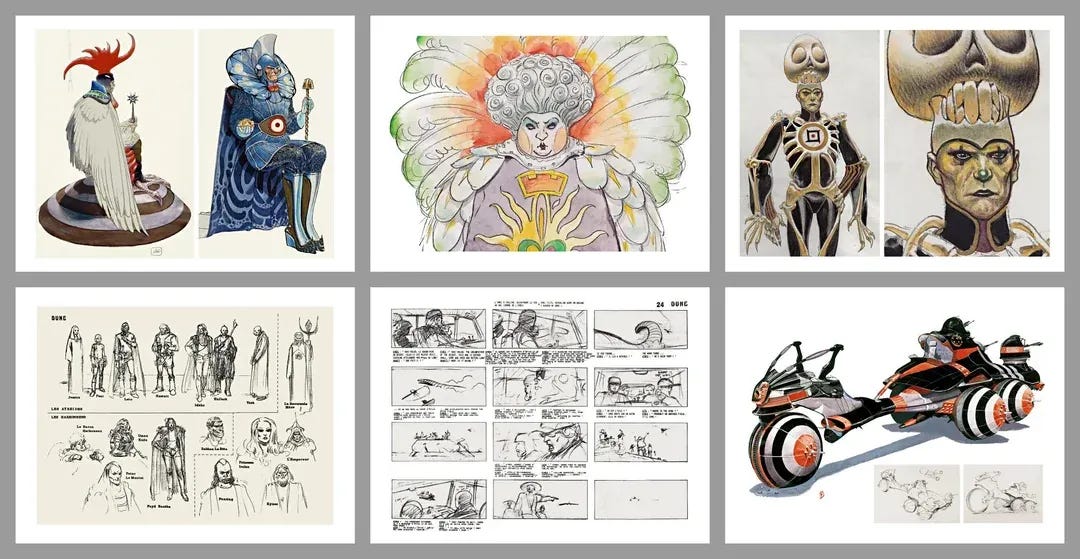

In November 2021, Spice DAO, a decentralized autonomous organization (DAO), purchased a rare copy of Jodorowsky's Dune storyboard for €2.66 million (~$3 million), surpassing its estimated value by 100x. The book, one of approximately 20 copies created in the 1970s, contained concept art and scripts for Jodorowsky’s unrealized film adaptation of Frank Herbert’s novel. Spice DAO framed its acquisition as an act of cultural liberation, pledging to digitize the manuscript, produce an animated series, and support community-driven projects.

However, the DAO misunderstood the legal landscape. Owning the physical book did not confer copyright to its contents, which remained with Jodorowsky, original artists like Moebius and H.R. Giger, and other rights holders. This critical oversight rendered their plans for derivative works legally untenable. As one critic noted, the storyboard’s images were already publicly accessible online, undermining the DAO’s preservation narrative.

Structural Flaws and Dissolution

Spice DAO’s governance model exacerbated its challenges. The organization relied on a "crowdraise" mechanism, where contributors received voting tokens proportional to their financial stake. Despite raising $750,000 initially, the DAO struggled to reconcile its decentralized ethos with the practical demands of asset management. Disputes arose over whether the storyboard belonged to the DAO or its founder, Soban Saqib, who fronted the auction funds. By July 2022, internal conflicts and legal ambiguities led to the DAO’s dissolution, with plans to auction the storyboard again.

Case Study 2: Martin Shkreli, PleasrDAO, and Once Upon a Time in Shaolin

Shkreli’s Acquisition and Legal Repercussions

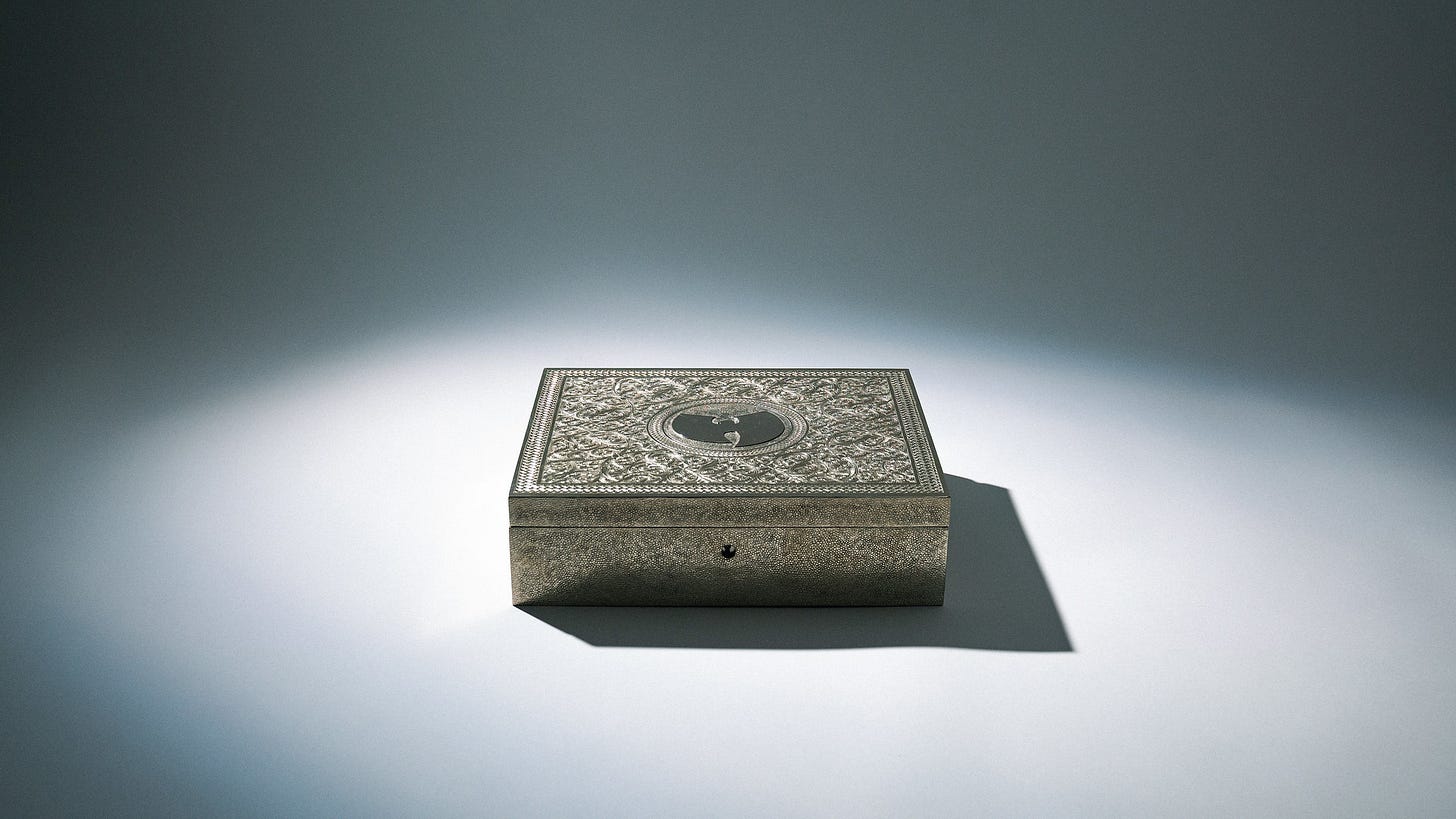

In 2015, pharmaceutical executive Martin Shkreli purchased Wu-Tang Clan’s Once Upon a Time in Shaolin for $2 million. The album, produced as a single copy to protest music’s devaluation in the digital age, included a contract stipulating no commercial exploitation until 2103. Shkreli’s subsequent securities fraud conviction led the U.S. government to seize the album, selling it to PleasrDAO in 2021 for $4.75 million.

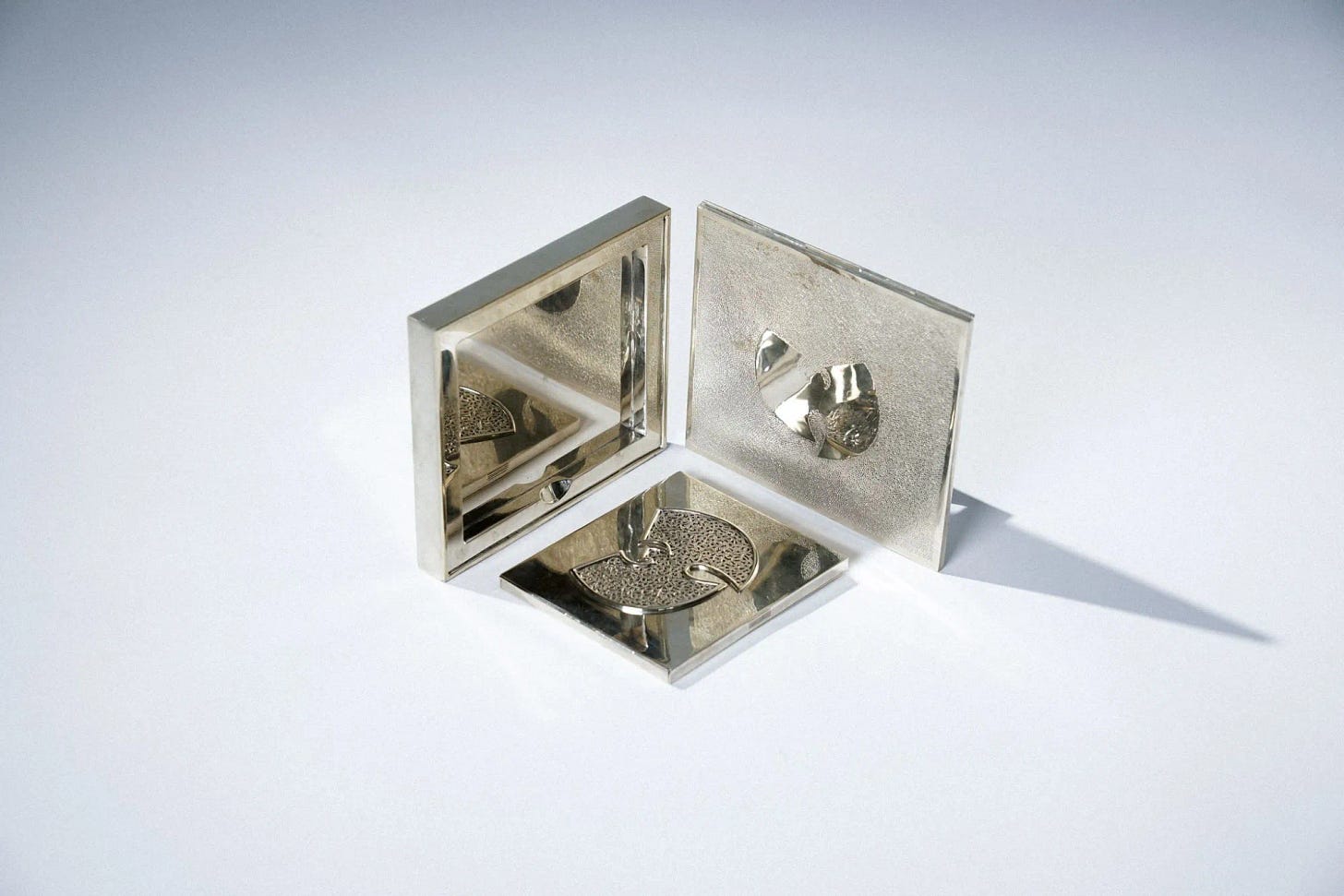

Unlike Spice DAO, PleasrDAO recognized the legal constraints but innovated within them. They tokenized ownership via a non-fungible token (NFT), enabling 74 members to collectively hold the album. However, Shkreli retained digital copies, which he leaked during a 2024 livestream, triggering a lawsuit from PleasrDAO. A court order compelled Shkreli to surrender all copies, reaffirming the album’s contractual exclusivity.

Fractional Innovation and Public Access

PleasrDAO’s approach balanced preservation and accessibility. They loaned the album to Tasmania’s Museum of Old and New Art for public listening sessions and offered $1 NFT "splinters" that accelerate its release by 88 seconds per purchase. This model democratized access while respecting the original 2103 commercialization moratorium, though critics argue it commodifies cultural heritage.

Fractional Ownership: Preservation Tool or Commercial Gimmick?

DAOs as Custodians

Proponents argue DAOs democratize access to assets. Spice DAO’s failure, however, highlights risks: poor legal due diligence, governance fragmentation, and misaligned incentives. Conversely, PleasrDAO’s structured NFT framework-built on Splint Invest’s regulated fractionalization platform-demonstrates how blockchain can enhance transparency and liquidity. By splitting ownership into tradeable tokens, PleasrDAO lowered entry barriers while maintaining compliance.

Preservation Ethics

The Dune case reveals a preservation paradox. While Spice DAO sought to "liberate" the storyboard, its contents were already digitized, rendering their efforts redundant. In contrast, PleasrDAO’s controlled listening parties and NFT model created new archival pathways without violating copyright. As Artemundi’s Picasso fractionalization shows, blockchain can preserve provenance and fund conservation, but only when paired with legal rigor.

Impact on Creator Credibility and Future Value

Reputational Risks

Spice DAO’s missteps damaged its credibility. The DAO’s inability to deliver on promises fueled perceptions of crypto naivety, potentially deterring future collaborations between artists and decentralized entities. Conversely, Wu-Tang’s album gained notoriety through Shkreli’s infamy and PleasrDAO’s innovative stewardship, arguably enhancing its cultural cachet.

Economic Implications

Both cases underscore how scarcity and controversy amplify value. The Dune storyboard’s price surged due to DAO-driven speculation, while Once Upon a Time in Shaolin’s NFT model created secondary markets that could benefit future creators. However, such models risk prioritizing investor returns over artistic intent, as seen in Masterworks’ commodification of blue-chip art.

Analytical Takeaways

Legal Literacy Is Non-Negotiable: Spice DAO’s collapse and Shkreli’s leaks highlight the perils of ignoring IP law. DAOs must consult legal frameworks.

Fractional Ownership Requires Regulation: PleasrDAO’s success hinged on partnerships with regulated platforms like Splint Invest. Unregulated models, as seen in Spice DAO, invite governance chaos.

Preservation vs. Exploitation: Blockchain can enhance preservation through transparent ownership trails, but projects must prioritize archival integrity over profit. The Dune storyboard’s digitization offered no new value, whereas PleasrDAO’s listening sessions expanded access responsibly.

Creator Incentives: While sales generate short-term buzz, long-term credibility depends on respecting artistic intent. Wu-Tang’s 2103 moratorium forced PleasrDAO to innovate within boundaries, whereas Jodorowsky’s unresolved rights stifled Spice DAO.

Conclusion

The Dune and Wu-Tang cases exemplify blockchain’s dual-edged potential in cultural stewardship. DAOs and fractional models can democratize access and fund preservation, but their success hinges on legal compliance, ethical transparency, and alignment with creators’ visions. As the art world grapples with digitization, these cases offer a roadmap-and a cautionary tale-for balancing innovation with respect for intellectual heritage. Future projects must prioritize multidisciplinary collaboration, uniting technologists, lawyers, and preservationists to navigate this evolving landscape.