Mastering the Pokémon TCG Market: An Actionable Guide to Collecting, Trading, and Profiting in a $13 Billion Industry

This paper provides a strategic roadmap for entering this lucrative market...

Executive Summary

The global trading card market, valued at $13.3 billion in 2024, is projected to surge to $36 billion by 2034, driven by a 13% CAGR. Pokémon, the dominant force in non-sports trading cards, has revolutionized this space with 3.7 billion cards sold in 2020/2021 and digital innovations like Pokémon TCG Pocket, which generated $598.8 million in six months. This paper provides a strategic roadmap for entering this lucrative market, blending education, acquisition tactics, and next-gen selling platforms to maximize returns.

I. Market Landscape and Growth Drivers

The Numbers Behind the Boom

eBay’s Dominance: Trading cards accounted for $1 billion GMV in Q1 2021 (10% of U.S. sales), with Pokémon consistently ranking among top searches.

Digital Integration: Pokémon TCG Pocket’s $275 million Japanese revenue signals a shift toward hybrid physical/digital collecting.

Key Investment Segments

Vintage Powerhouses: PSA 10 1st Edition Charizards (121 globally) remain blue-chip assets, though liquidity challenges persist.

Modern Sleepers: Evolving Skies booster boxes surged in value (2021–2024).

Cultural Moments: The Van Gogh Museum collab spiked “Pikachu Van Gogh” searches by 11,000% on eBay.

II. Building Expertise – The Collector’s Curriculum

Foundational Learning Resources

Udemy Course: Mitchell Bouchard’s Pokémon Trading Card Investing & Collecting Course teaches grading, spotting fakes, and eBay/Facebook deal-hunting.

Community Engagement: Reddit’s r/pkmntcg (1.2M members) offers real-time arbitrage alerts and trend analysis.

Tools:

PriceCharting:Tracks historical eBay sales.

CGC Centering Tool: Ensures card grading precision.

Grading Mastery

PSA vs. CGC: BGS 9.5 cards fetch 20% premiums in EU markets. Submit 50+ cards quarterly for bulk discounts.

Condition Criteria: Mint cards require:

Centering: 55/45 front, 75/25 back

Edges: No whitening

Surface: Zero scratches under LED light

III. Acquisition Strategies – Where and How to Buy

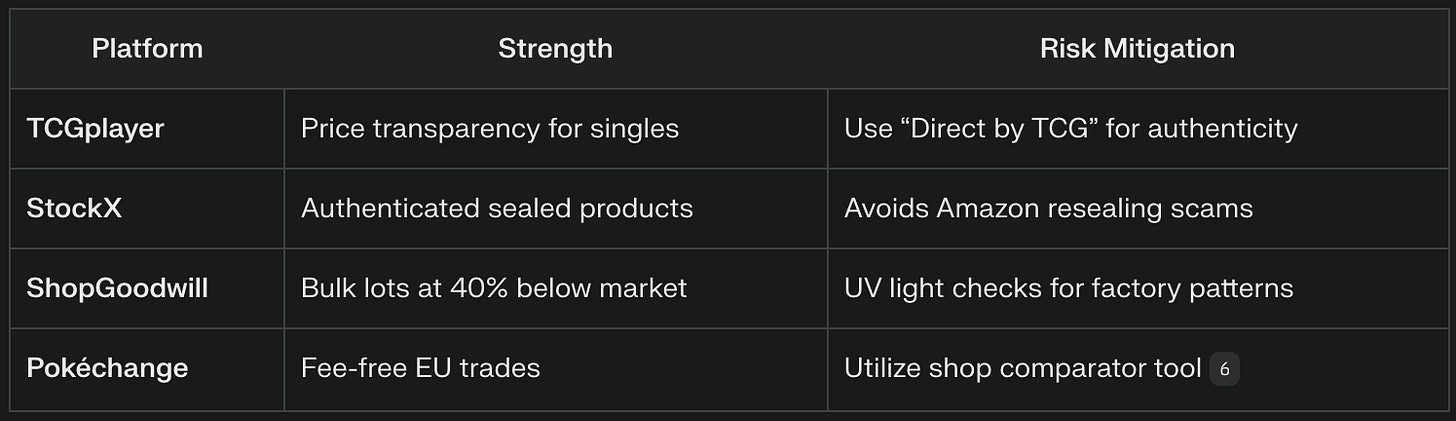

Platform-Specific Tactics

Regional Arbitrage Opportunities

Japan-First Releases: Pokémon 151 Japanese boxes resold for 300% markup pre-English launch.

Graded Crossovers: Target PSA 10 modern alt arts (e.g., Evolving Skies Sylveon VMAX) for 15% annual appreciation.

IV. Next-Gen Selling Platforms & Emergent Marketplaces

Digital and Hybrid Models

Pokémon TCG Pocket: Sell digital pulls on gray-market Discord servers (30% premiums).

Fractional Ownership: Platforms like Rally Rd. allow micro-investments (e.g., 1% of Pikachu Illustrator for $900).

V. Risk Mitigation and Portfolio Management

Combatting Fraud

Authentication: Use 10x loupes to check holographic patterns. Fake “rainbow rares” lack layer separation.

Insurance: Collectibles riders cover theft/damage ($10k coverage ≈ $120/year).

Tax Optimization

IRA Holdings: PSA 10 “investment grade” cards qualify for tax-deferred growth.

28% Collectibles Tax: Offset with losses from bulk commons.

Conclusion

The Pokémon TCG market’s growth hinges on bridging physical nostalgia with digital innovation. As Pokémon TCG Pocket and AI-driven tools like BlockApps democratize access, collectors must adopt hybrid strategies. By mastering arbitrage, leveraging emergent platforms, and mitigating risks, enthusiasts can capitalize on this $58.2 billion arena-where every card is a potential Rare Candy for portfolio growth.

Gotta Invest ’Em All.